In a surprising turn of events on January 10, 2025, stocks for IonQ and Rigetti Computing took a steep dive, plummeting sharply after Nvidia CEO Jensen Huang made a bold prediction that “very useful quantum computers” are still twenty years away. This announcement sent shockwaves throughout the quantum computing sector, leading to significant losses for several companies associated with this cutting-edge technology.

Impact on Quantum Computing Stocks

The immediate effect of Huang’s statements was stark. On the day of the announcement, Rigetti’s stock nosedived by a staggering 45%, marking a significant drop that has raised concerns among investors. Meanwhile, IonQ experienced its own downturn, falling by 39%. Other companies in the quantum computing space, such as D-Wave Quantum, also saw their stock prices tumble. The market reacted heavily, reflecting widespread anxiety about the future of quantum technology.

Why the Downturn Matters

Huang’s remarks called into question the rapid advancements that many in the technology sector have anticipated. He noted that quantum computing, while promising, is not yet at a stage where it can tackle all computational problems effectively. This created a chilling effect on stocks, especially after a period where quantum computing stocks had been on the rise due to significant technological breakthroughs and government backing. Investors were forced to reckon with the realities of the market after being buoyed by earlier surges.

Recent Market Trends

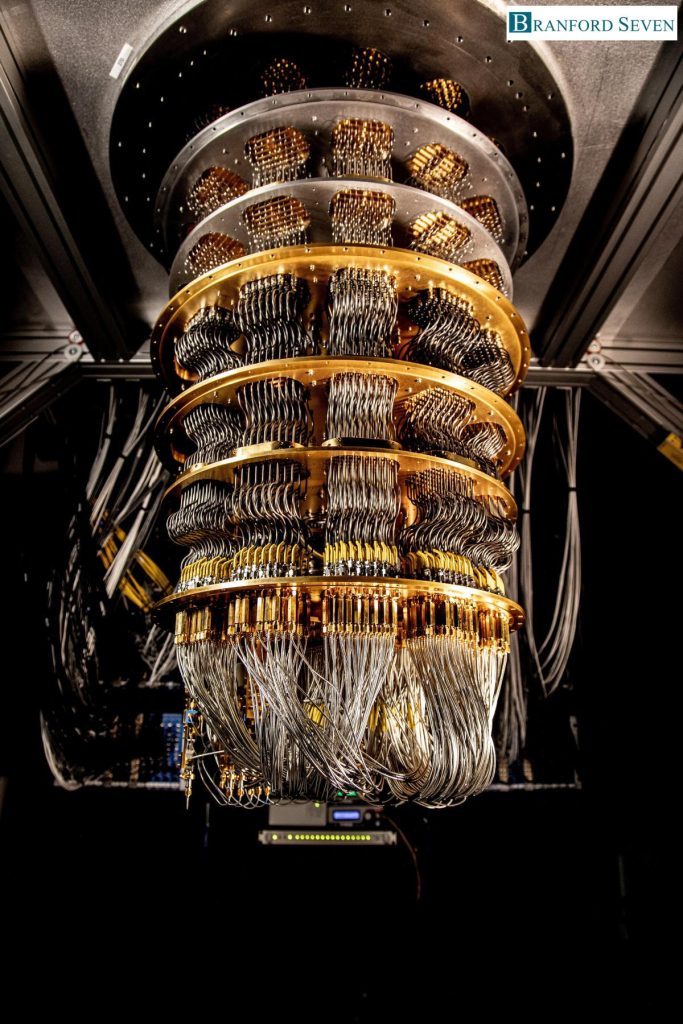

Prior to the announcement, both IonQ and Rigetti, along with their peers, had experienced considerable gains powered by innovations in quantum technology and news of expanded funding from the U.S. government. For instance, a bipartisan Senate bill introduced in December proposed a hefty $2.7 billion for quantum computing research. Companies like Amazon and Google had also been making headlines with new advancements, such as an advisory program from Amazon and Google’s unveiling of its new quantum computing chip, Willow. These developments had many believing that the quantum revolution was just around the corner.

The Perspective of Analysts

Despite the recent decline, several analysts still see potential in IonQ and Rigetti’s future. For example, Benchmark raised its price target for IonQ to $22, and Needham & Company set their target at $18, emphasizing a positive outlook despite the market’s immediate reaction. These price predictions suggest that experts believe in the fundamental value and future potential of these companies, even if the short-term outlook appears gloomy.

What This Means for Investors

For everyday investors, these swings can be alarming. Many might be wondering what to do next with their investments in quantum computing stocks. As analysts suggest looking for long-term growth and focusing on the advancements being made, it’s vital to remember that market fluctuations are a normal part of investing. While immediate drops can feel overwhelming, the potential for future gains in the tech sector, especially quantum computing, remains a topic of interest for many skilled investors.

Looking Ahead

As we look forward, the future of quantum computing will likely continue to be influenced by both technological advancements and investor sentiment. While Huang’s prediction casts a long shadow, leading companies in the field such as IonQ and Rigetti are not backing down. They continue to develop innovative technologies, striving to push the boundaries of what quantum computers can do. Enthusiasts and investors alike will be watching closely as these companies work to turn predictions into realities.